Maui Vacation Rental Statistics

In fiscal year 2022-2023 Maui County’s operating budget is the largest ever set at $1.07 Billion dollars, and for the first time will be going into the billions of dollars. This will be over a $200 Million increase, or 27% over last fiscal year. Read more about the budget here. The way the County of Maui sets the real property tax, the largest source of revenue for their budget, is to first figure out how much they plan to spend in the upcoming year, and then setting the real property tax figure to balance the budget.

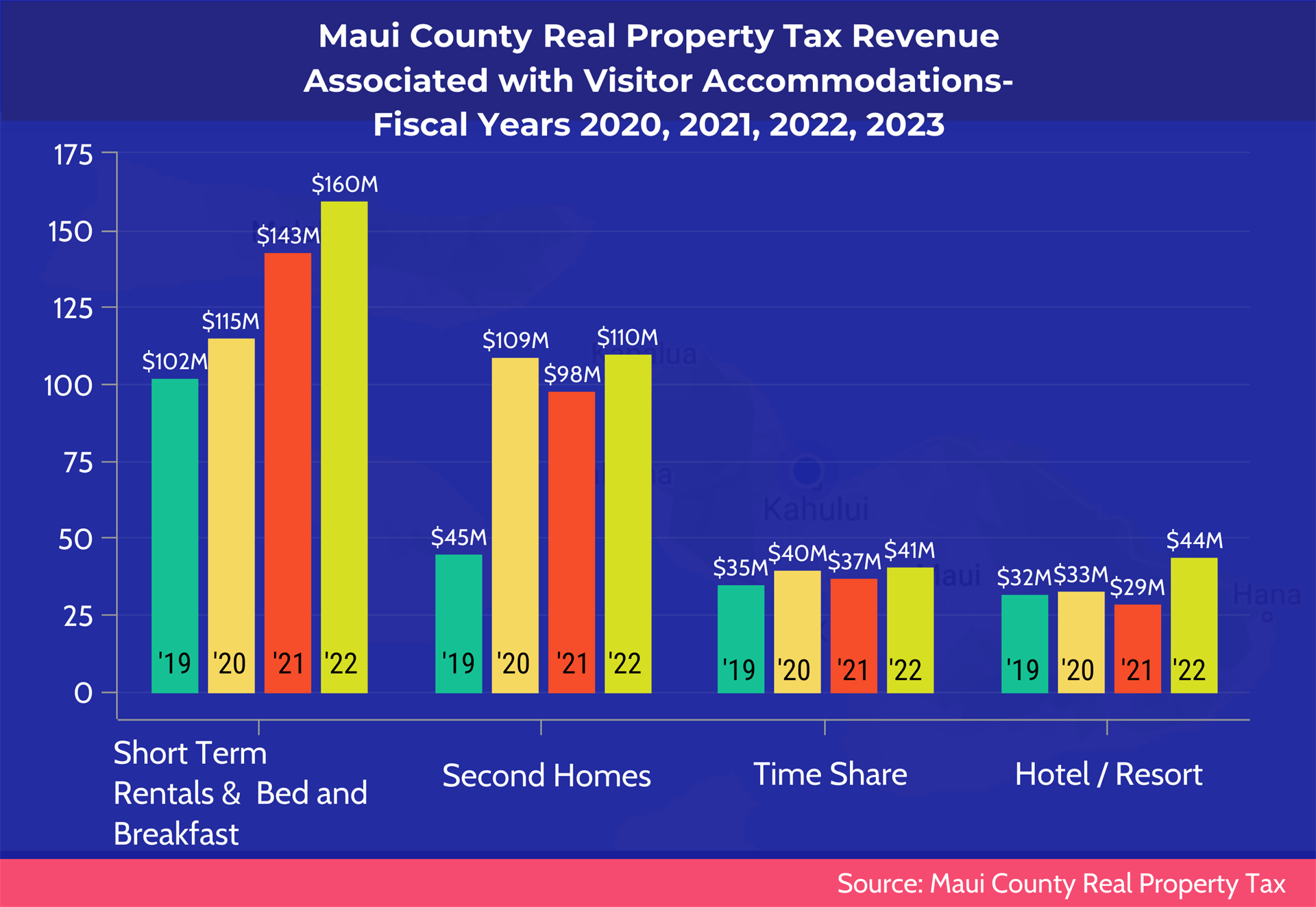

In all, the county will raise $430 Million in property tax revenue. Vacation Rentals will raise $160 Million in RPT tax, 12% more than last year. This was an increase of $17 Million in tax dollars, the highest increase in all the tax classifications. This year Short Term Rentals represents 37% of the real property tax revenue, and 15% of the total operating budget.

Much of the increases in revenue in property taxes overall came from the increase in values of properties. Total assessments rose $4 Billion overall in Maui County in fiscal year 2022-2023. Increases in assessed values were 5% overall in the short term classification. Short term rentals will contribute $12.1 Million in revenue to the Affordable Housing Fund, the largest contribution of all the classifications, and the largest contribution to date. Over the last 5 years the short term rental classification has generated $31.5 million dollars for the affordable housing fund.

Visitor accommodations raise 82% of Maui’s property tax revenue with second homes included. These numbers show Short term rentals are a significant contributor to the County of Maui, and a legitimate and critical part of the economic engine for Maui.

.png)

Maui County’s operating budget has increased to over 1 Billion dollars in its current fiscal year. Most of the county’s revenue comes from the short term rental classification, and the small businesses creating this revenue. The county of Maui has long had a strategy of taxing the Short Term Rental Classification in order to keep taxes low for the residents. A big part of this strategy is by means of the property assessment values that the County assessment division attributes to these properties.

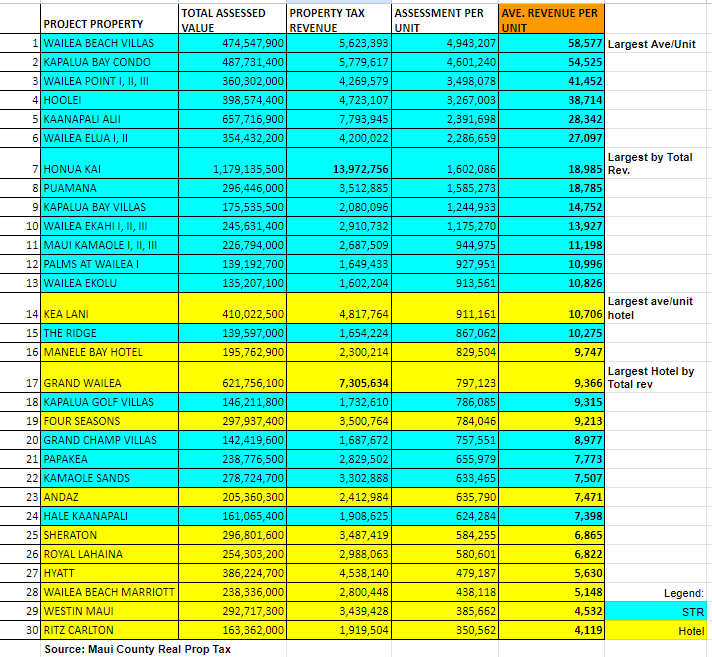

Looking at the top 30 real property tax revenue generating legal visitor accommodations in Maui county, you can see that the assessment of many short term rentals result in a higher rate and tax revenue than many of our hotel properties.

When looking at average tax revenue generated on a per Unit basis, the top 13 properties are all legal vacation rental properties. The top Hotel, the Kea Lani falls behind all of these at number 14 on this same list.

TOP REVENUE GENERATING

SHORT TERM RENTAL AND HOTEL PROPERTY

MAUI COUNTY 2023